Navigating climate disruption in the building sector

Builders, facing climate change, can create opportunities through preemptive actions across their value chain August 2022

August 2022

Builders, facing climate change, can create opportunities through preemptive actions across their value chain. FIrst published on GreenBiz

Climate change is disrupting the building and real estate sectors

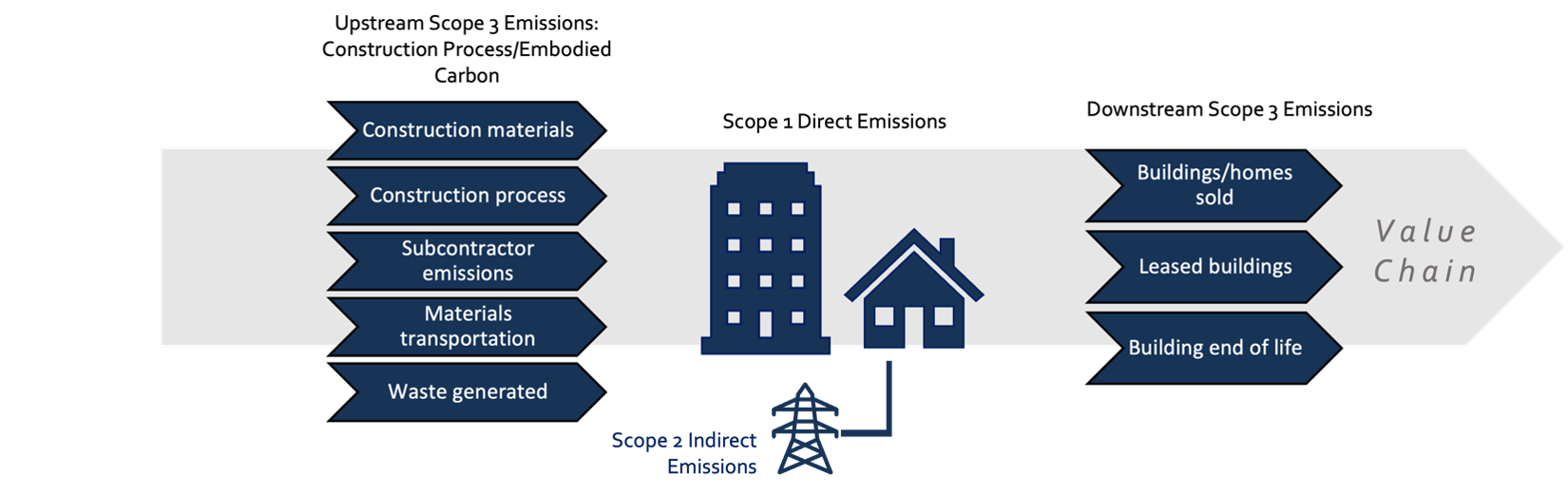

Why are buildings so important when we talk about climate change? Generating nearly 50 percent of global carbon emissions (40 percent in the United States), the building sector has a critical role to play in limiting carbon emissions. Buildings’ embodied carbon — the greenhouse gases (GHGs) emitted during construction and from the production and transport of materials before the building is operational — alone account for around 20 percent of global emissions and will produce 74 percent of all CO2 emissions of new buildings in the next decade. Operational carbon (including lighting, heating/cooling, ventilation) accounts for 27 percent of total emissions. In commercial buildings, 30 percent of the energy used is wasted. Beyond buildings’ large contribution to climate change, the sector must also grapple with the increasing climate-related risks they face along their value chains. However, along with these risks come opportunities for companies that assess, measure and address their carbon impact and climate exposure.

Climate change risks can be financially material

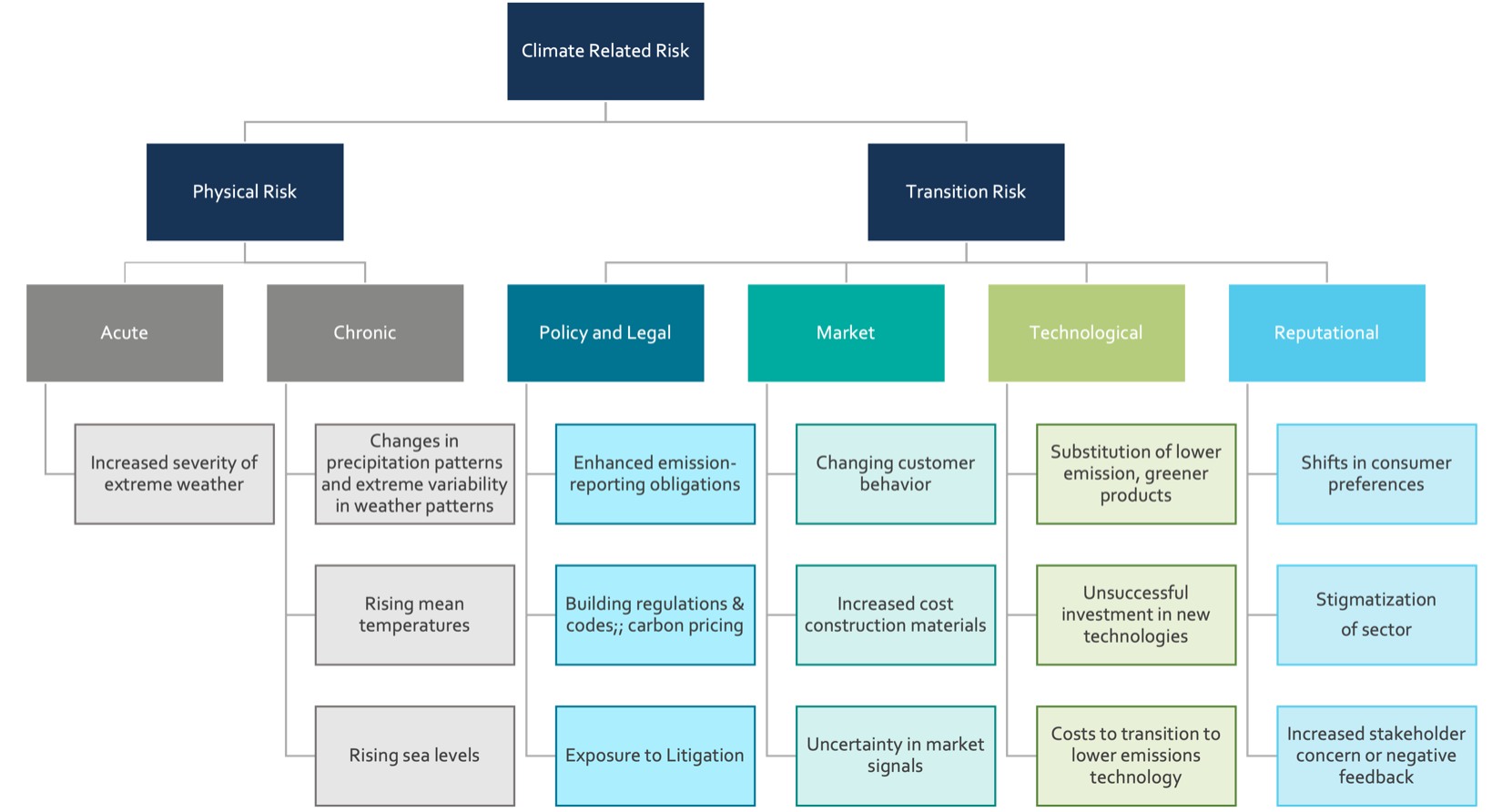

In addition to the impact of construction and building operations on GHG emissions, the building sector faces multiple climate change risks. Physical risk arises from the increasing frequency and intensity of weather events and their impacts (hurricanes, tornadoes, flooding, subsidence, sea-level rise, wildfires, extreme temperatures), causing disruptions to the supply chain, higher raw material costs, building delays and damage to physical assets. It is critical to increase the sector’s resilience to these physical risks.

Companies may be exposed to transition risks as society and the market transition to a lower-carbon economy. The Task Force on Climate-Related Financial Disclosures (TCFD) divides transition risk into policy and legal risks, technology risk, market risk and reputation risk. These risks result in potential financial impacts to companies’ financial stability.

Climate change is increasingly front and center for investors, regulators and policymakers

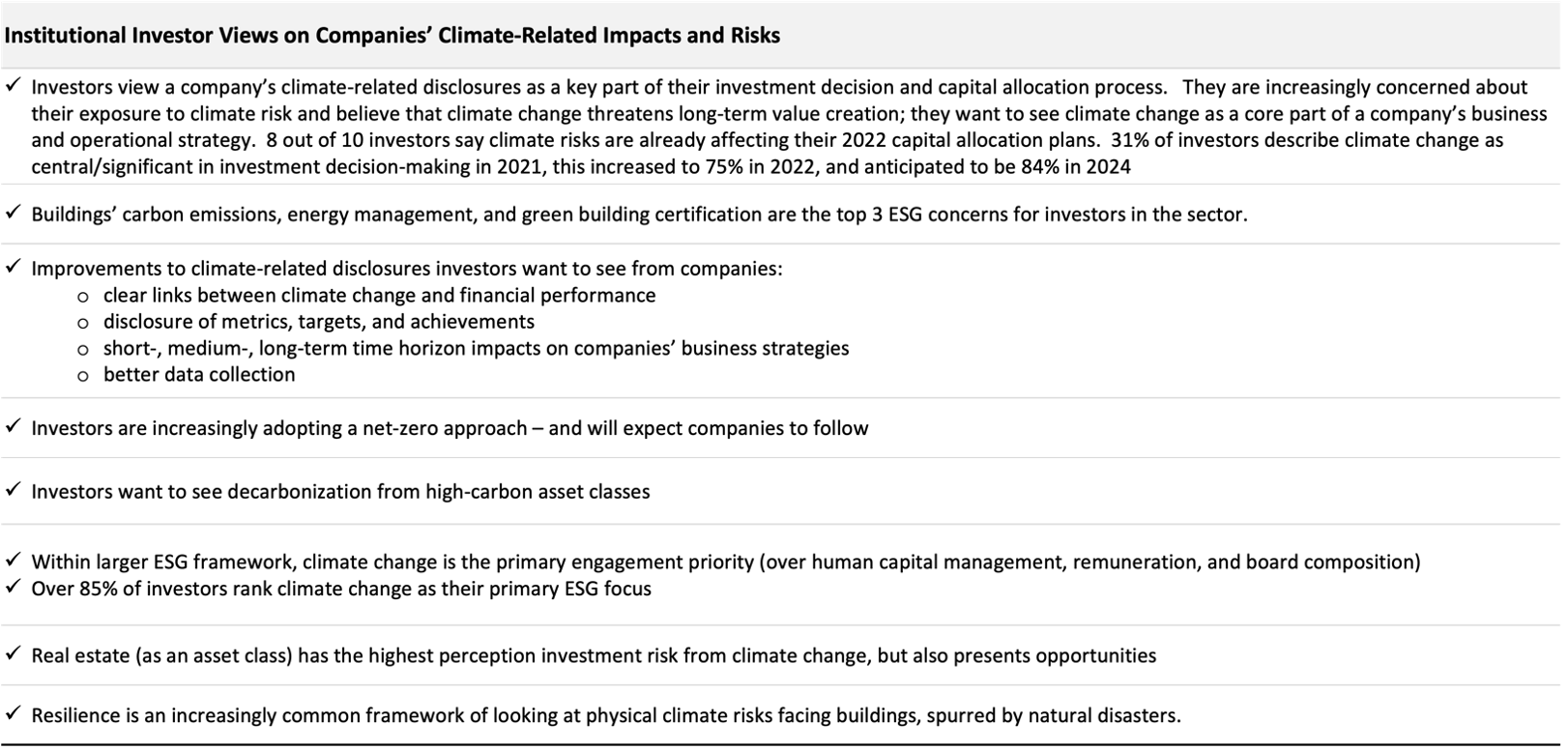

The sector is facing increasing pressure to act on climate change. Not taking action gives rise to transition risk. Policymakers are advancing legislation on local, state, and federal levels to limit embodied and operational carbon emissions through stricter building codes requiring increased energy efficiency and physical resiliency. Regulators are setting carbon-reducing agendas, and mandatory climate-related disclosure is being proposed by the SEC. Investors are increasingly asking companies in the building sector to voluntarily report on their carbon emissions, quantify their climate-related risk and take action to decarbonize. They want to understand their exposure to climate-related risk and to have consistent, reliable data to inform their allocation decisions; many builders must adapt to investor demands. An overview of surveys of institutional investors’ perspectives on climate change and the building sector found that climate change is increasingly dictating where capital is going.

The sector is feeling the impact of investors’ increased focus on climate change and corresponding rise in their demand for climate-related impacts and risk. Investors are demanding more transparency and urging companies to report on their climate impact and risks.

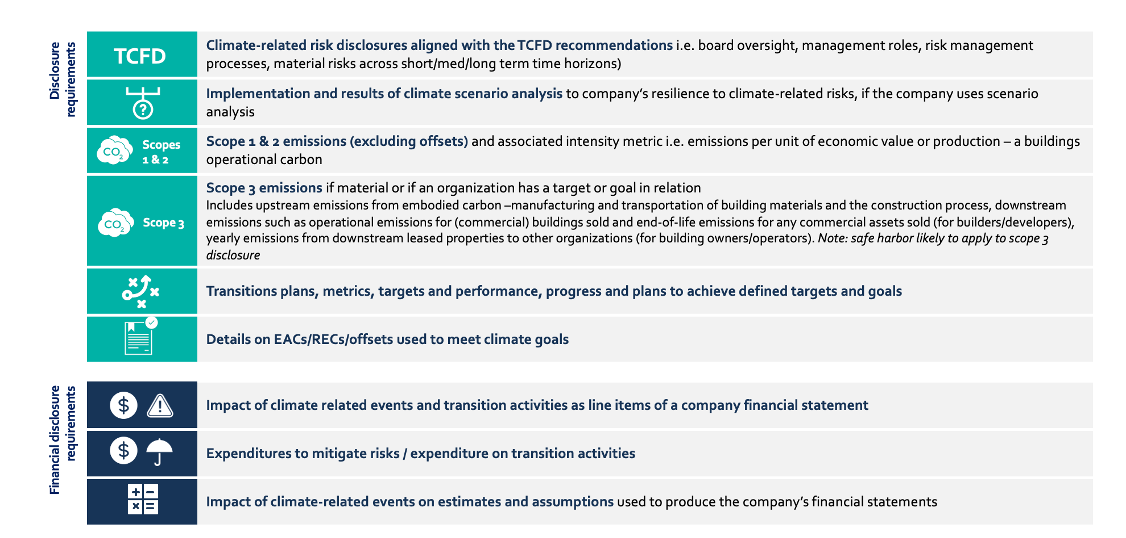

The Securities and Exchange Commission (SEC) announced a proposed rule at The Enhancement and Standardization of Climate-Related Disclosures for Investors in March. Due to go into effect at the end of 2023, the regulation will require publicly listed companies to disclose their climate-related risk (physical and transition), as well as their impact (embodied and operational GHG emissions) on climate change.

The SEC proposal underscores the importance for investors to have consistent, comparable and accurate information from companies, instead of the lack of comparability and fragmented approach that currently exists. However, compliance will be tenuous, costly and difficult for the building sector. There are a great many unknowns — from predicting future climate risks and associated costs, to fully capturing upstream and downstream Scope 3 emissions, which depend on third-party data collection and reporting.

Several other federal, city and state developments affect the building sector. The recent Inflation Reduction Act of 2022 authorizes $369 billion in federal spending on energy and climate change and contains provisions that affect property owners, including tax credits that increase buildings’ energy efficiency and make low-carbon HVAC and water heaters, mini-split heat pumps and residential solar less expensive.

Cities are increasingly enacting climate change policy to reduce GHG emissions — and building emissions are at the forefront of cities’ climate action plans. New York City’s Local Law 97 (LL97) is an example of one of the more stringent climate change laws enacted. LL97 limits emissions of more than 60,000 buildings — 60 percent of the city’s building stock (59 percent residential; 41 percent commercial). With the new limits, most buildings will need to decrease carbon emissions by 40 percent by 2030 and 80 percent by 2050. The regulation will require many buildings to undergo extensive retrofitting of energy-efficient upgrades. All buildings and new construction over $25,000 will need to disclose their GHG emissions, and the disclosures need to be certified. This local law introduces carbon pricing mechanisms with fines of $268 per metric ton of carbon dioxide equivalent above the building’s annual carbon emissions limit. Cities are increasingly reporting on their climate impact, risk and adaptation/mitigation strategies — CDP saw a 33 percent increase in U.S. cities submitting disclosures from 2017 to 2021. The trickle-down effect on the building sector will be the development of more regulations like Local Law 97

Risk creates opportunity: Moving toward climate resilience

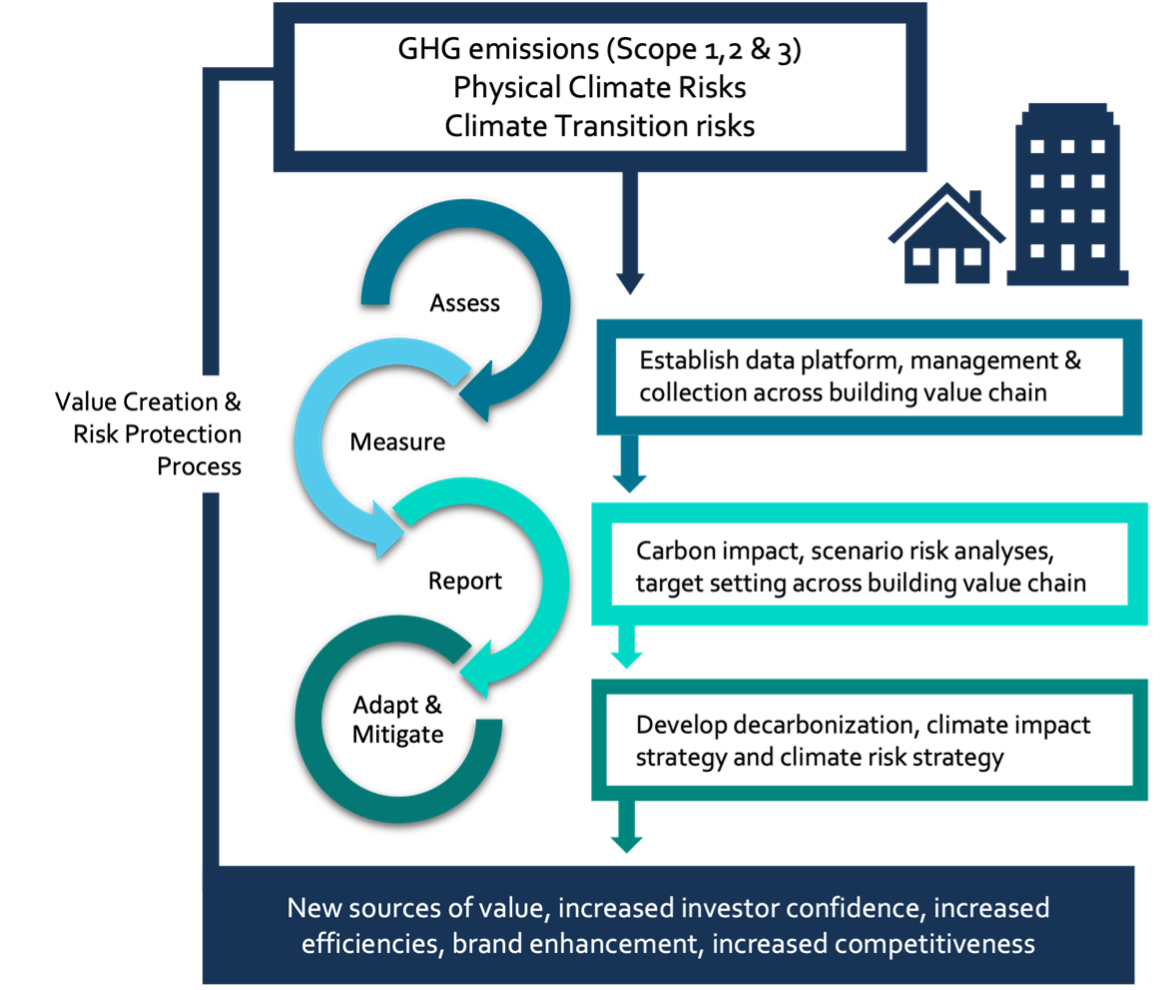

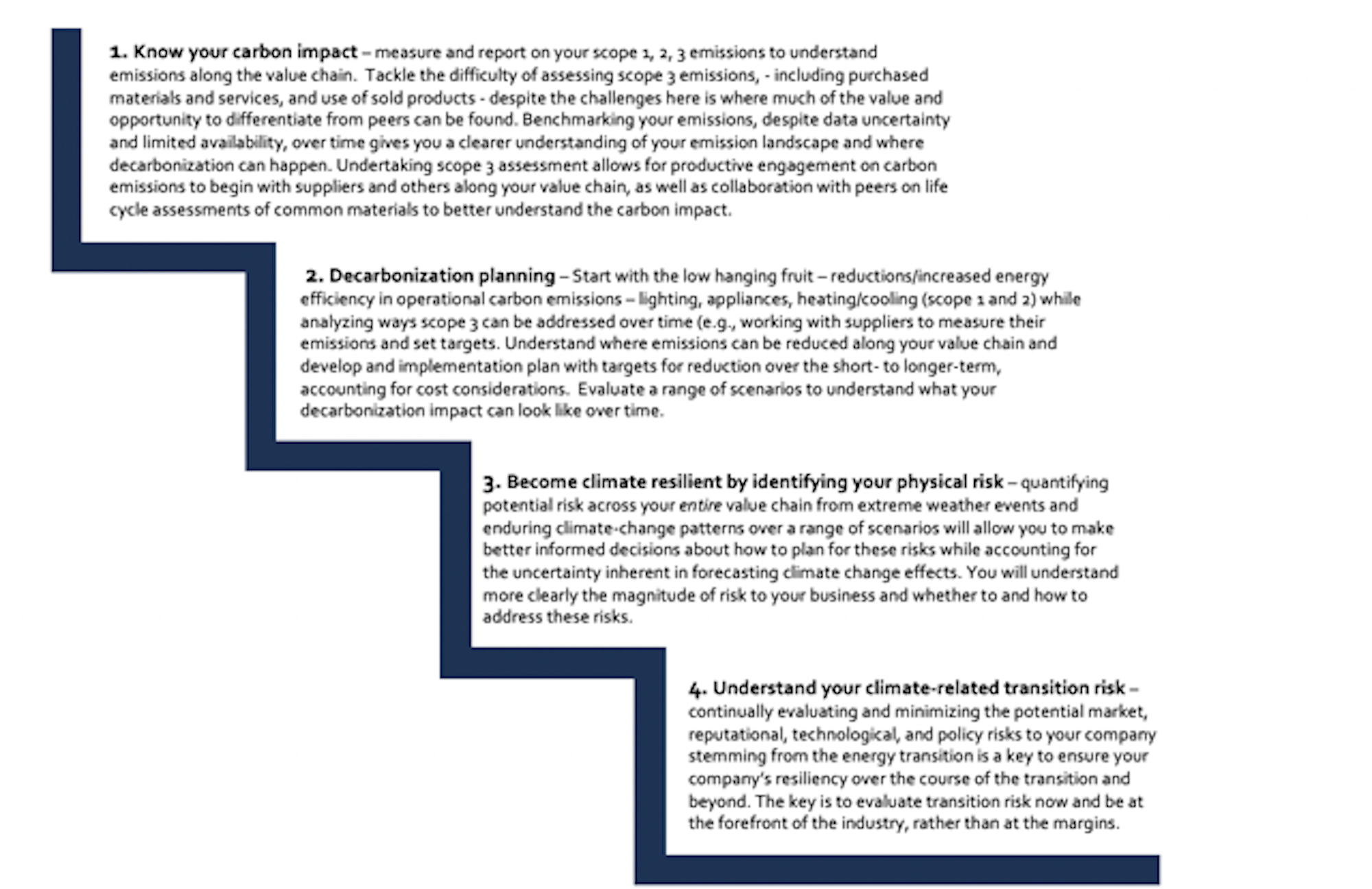

So where does this leave the building sector? The flip side to the pressures facing the sector is that the challenges create opportunities. Exploiting these opportunities will help decrease companies’ climate impact as well as reduce future climate-related transition and physical risk. The opportunities come at a cost, requiring a reengineering of operating models, but in the long run can ensure greater financial and physical resiliency for the building sector. The key is to get ahead of the curve by preemptively assessing, measuring, reporting on, adapting to and addressing climate-related risks and impacts or chance being sidelined by more responsive and innovative competitors.

A call for preemptive action: The opportunities from preemptively addressing climate change can be realized throughout the value chain and across risk factors. Value-add arises from the capitalizing on opportunities; increased investor confidence and better positioning to attract new investment/financial capital; increased competitiveness, brand and reputation enhancement; attracting new clients; increased efficiencies/cost savings from lower operational costs; and decreased risk exposure.

The How: Steps to value and resiliency

New sources of value are found from incorporating low-carbon materials and technologies in construction such as green concrete, recycled materials, green-certified building materials and low-emission flooring/carpet, glass and paint — decreasing embodied carbon. Using more energy-efficient technologies in heating/cooling, lighting and appliances and incorporating passive solar/renewable energy also create value. Additionally, architectural design innovations and avoiding building in high-risk locations (flood zones, coastal areas, areas of water scarcity) add value. Over the longer term, builders can realize cost savings as the prices of new materials and technologies fall and see higher prices for sustainable, low carbon and climate-resilient buildings.

As builders increase transparency around their carbon impact and climate risk, investors, customers and suppliers take notice. Builders have less exposure to policy, market forces, technological disruptions and climate events as they have prepared and are a part of the energy transition — not on the sidelines having to scramble.